Disability Tax Credit (DTC)

The disability tax credit (DTC) can help reduce the taxes that someone with disabilities, or their supporting family members, may have to pay. It also offers a lot of other great benefits.

What is the DTC?

The Disability Tax Credit (DTC) is a non-refundable income tax credit that helps someone with disabilities (or their caregiver) reduce the amount of income tax they pay when they file their taxes.

The DTC also allows people with disabilities to access other federal disability benefits such as the Child Disability Benefit (COB), the Canada Caregiver Credit (CCC), the Registered Disability Savings Plan (RDSP) and the Canada Disability Benefit (CDB).

What is the Financial Benefit?

What is the Financial Benefit?

- The Credit you can claim on your tax return is $10,138 (disability amount 2025), plus the $5,914 (supplement for children with disabilities 2025). Because the federal non-refundable tax rate is about 15%, the amount your taxes may be reduced is about $1,500..

- The DTC is retroactive, which means that if someone has been living with a disability in the years prior to applying, they can claim for up to the previous ten years.

- Unused credit amounts can be transferred to a caregiver to help reduce their taxes. For example, a parent can claim the DTC for a dependent child.

How to Qualify

There are no age restrictions.

Applicants must have a Social Insurance Number.

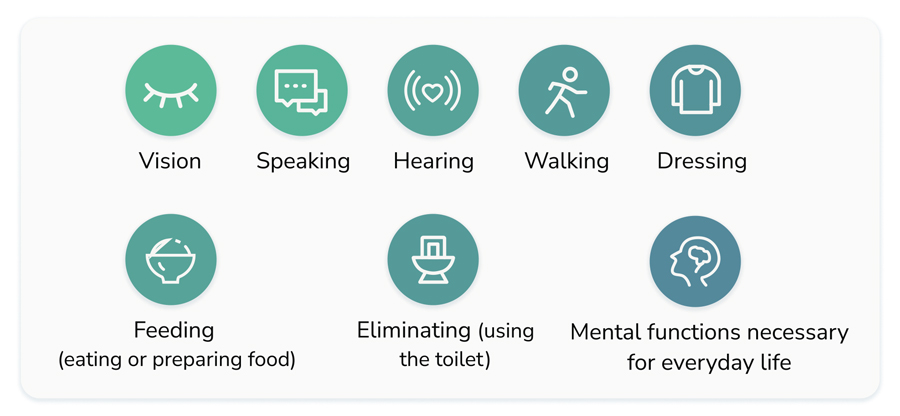

Applicants must have prolonged (at least one year) and significant physical or mental restrictions in one or more of the categories below or require life sustaining therapy.

How to Apply:

- To apply for the DTC, you must fill out a T2201 form with assistance from a relevant healthcare professional, such as a doctor (all sections), a nurse practitioner (all sections), optometrist (vision), speech language pathologist (speaking), audiologist (hearing), occupational therapist (walking, feeding, dressing), physiotherapist (walking), or psychologist (mental functions necessary for everyday life).

- You can find help with the application from Disability Alliance: Disability Tax Credit Tool

Tools

- Access RDSP (help with the DTC/RDSP): 1-844-311-7526 or

- BCANDS Indigenous RDSP/DTC Navigation Support: https://www.bcands.bc.ca

By Family Support Institute of BC