Estate Planning

Please also head over to our other toolkits for information on Guardianship and Rep Agreements and RDSPs.

When creating an estate plan for the financial future of a child with a disability, it’s important to gather all available resources to support yourself and your loved ones. Below are a number of community-based and government offered programs.

BC has a few organizations to assist in Estate Planning for Families with Disabilities:

Plan Institute offers a variety of resources and training on financial planning for individuals with disabilities and their families. Their guides can help parents understand government benefits, trusts, and other financial planning aspects.

NIDUS can help with forming a legal plan for the present and future and to prevent the need for Adult Guardianship controlled by the province. They provide education, support, and assistance around these important planning tools for person-led and estate planning.

PRO TIP

Check out PLAN’s new Future Planning Tool created by Self Advocates, for Self-Advocates

Why a Person with Disabilities Needs a Will

Everyone needs a will! It ensures that your wishes and instructions are followed after you pass away. For individuals with disabilities, having a will is especially important for several reasons:

1. Access to Funds – If a person with disabilities has assets such as a Registered Disability Savings Plan (RDSP), these funds may take a long time to be released if there is no will. This delay can impact plans for end-of-life expenses, including funeral costs.

2. Lack of Life Insurance Options – Many people with disabilities are denied life insurance, which means they cannot rely on a policy to cover funeral and other final expenses. A will can help ensure funds are allocated for these costs.

3. Too Much Paperwork – Without a will, loved ones must navigate complex paperwork and fees to settle the estate, adding unnecessary stress during a difficult time.

4. Legal Consequences of Dying Without a Will – Passing away without a will is called “dying intestate.” This means the government will decide how assets are distributed, which may not align with the person’s wishes. Learn more about intestacy laws on Nidus’s website.

5. Issues of Capacity – Some individuals with developmental disabilities may need assistance in creating a valid will. Consulting an estate attorney or organizations like Nidus can provide guidance on ensuring the will is legally sound.

Estate Planning Resources

BC Ministry of Attorney General offers guidance on wills, estates, and planning for the future, including considerations for individuals with disabilities.

- Death, Funeral Planning, Wills and Estates – Province of British Columbia

- Disability Law Clinic | DABC; Can provide referrals and other legal information

Watch & Learn

An Important Estate Planning Tool: Henson Trust or Discretionary Trust

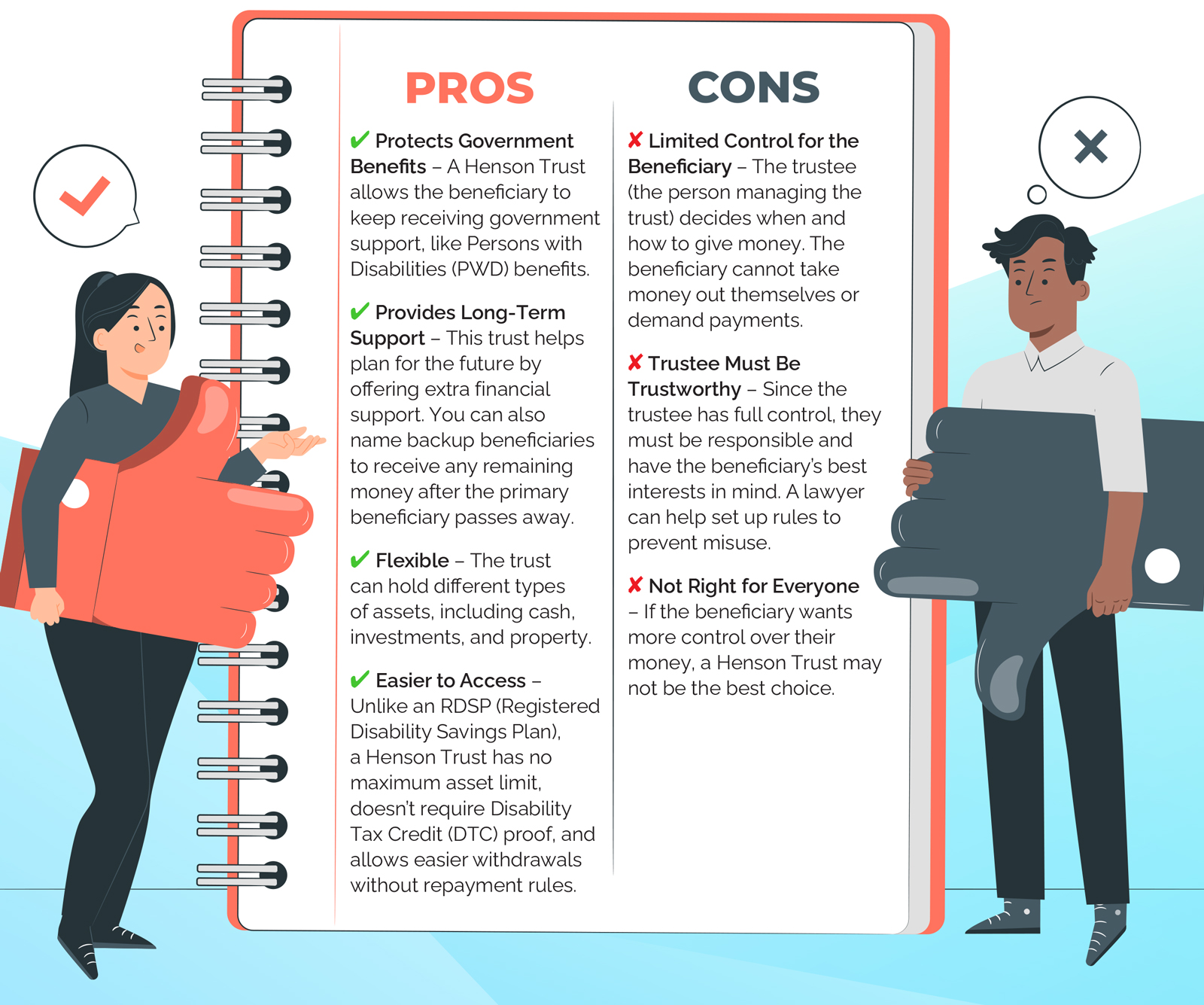

A Henson Trust is a special type of trust that helps people with disabilities keep receiving government benefits. If you leave money to someone with a disability outside of a trust, they might lose their benefits like PWD. But with a Henson Trust, the money is managed by a trusted person (called a trustee), who decides when and how to give money to the person with a disability. This way, they can still get support without losing their benefits.

Pros and Cons of a Henson Trust

Watch & Learn

It is valuable to connect with lawyers that are familiar with disability law in your community.

More information about Special Disability Trusts.

Resources

The following resources are financial planning resources and information to access Provincial and Federal financial support:

Accessing Provincial and Federal Financial Support

By Family Support Institute of BC