Disability Alliance of BC

Events from this organizer

-

-

Featured

FeaturedTax Tips for People with Disabilities

SESSION INFO: « Back to all events In this information session, learn more about why everyone should file taxes and how to get started. Specific topics will include: an overview of non-refundable and refundable tax credits (Disability Tax Credit, Canada Caregiver Credit, Child Disability Benefit); medical expenses; readjusting your taxes, and options for tax relief. […]

-

Featured

FeaturedTax Tips for People with Disabilities: Do it Yourself

SESSION INFO: « Back to all events In this information session, learn more about how you can file your taxes on your own, with guidance and helpful tips from an experienced tax filer. Get started using TurboTax software, completely free of charge. Presented by Vancouver Public Library in partnership with Disability Alliance BC. CLICK […]

-

-

Featured

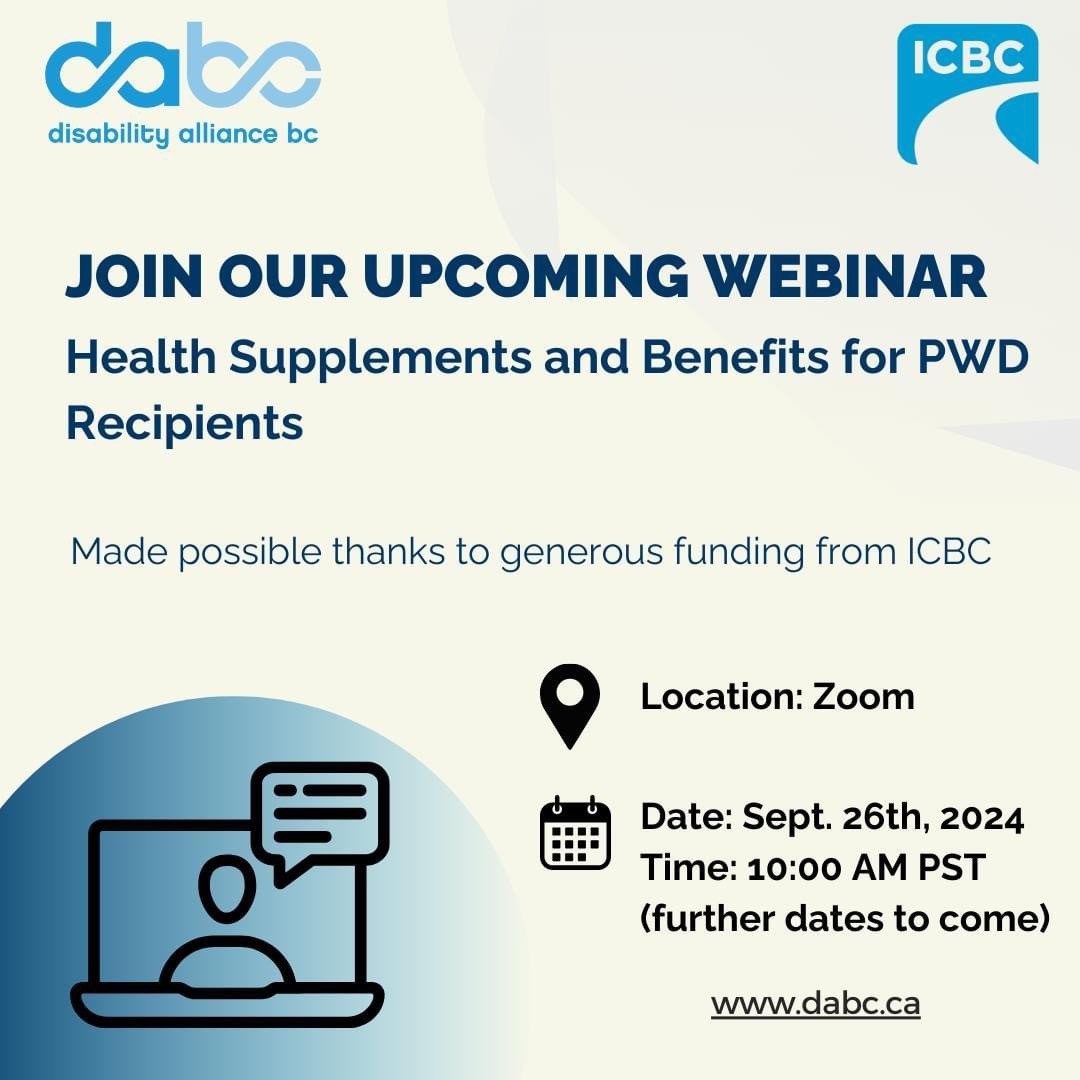

FeaturedHealth Supplements and Benefits for PWD Recipients

An in depth presentation on benefits and other health supplements that are available to people on provincial PWD. REGISTER HERE

-

-

Featured

FeaturedAsk an Expert – DTC and other Disability Tax Supports

Join this event for a moderated question and answer period facilitated by experts from Disability Alliance BC (DABC), BC Aboriginal Network on Disability Society (BCANDS), and Plan Institute (PI). This webinar will focus on questions related to the disability tax credit (DTC) and other disability related tax benefits, credits, and considerations. CLICK TO REGISTER

-

Featured

FeaturedAsk an Expert – RDSP and other Disability Financial Planning Considerations

Join this event for a moderated question and answer period facilitated by three experts from Plan Institute (PI). This webinar will focus on questions related to the registered disability saving plan (RDSP) and other disability related financial planning considerations for individuals and family caregivers. CLICK TO REGISTER